Staking has emerged as a popular way to earn passive income in the cryptocurrency world, offering an alternative to traditional methods like trading. But what exactly is staking, and how does it work? This comprehensive guide will break down everything you need to know about staking, from its basic principles to advanced strategies, empowering you to make informed decisions and potentially grow your crypto holdings.

What is Crypto Staking?

Understanding the Basics of Staking

At its core, staking is the process of holding cryptocurrencies to support the operations of a blockchain network and, in return, earning rewards. It’s similar to earning interest on a savings account, but instead of depositing fiat currency, you’re locking up your crypto to help secure the network.

Staking is predominantly associated with Proof-of-Stake (PoS) blockchains. In PoS, participants “stake” their crypto to become validators. Validators are responsible for verifying transactions and creating new blocks on the blockchain. The more crypto a validator stakes, the higher their chances of being selected to validate a block and earn rewards.

- Example: Ethereum transitioned to Proof-of-Stake in 2022. Instead of miners solving complex equations, ETH holders now stake their ETH to secure the network and earn rewards.

Proof-of-Stake vs. Proof-of-Work

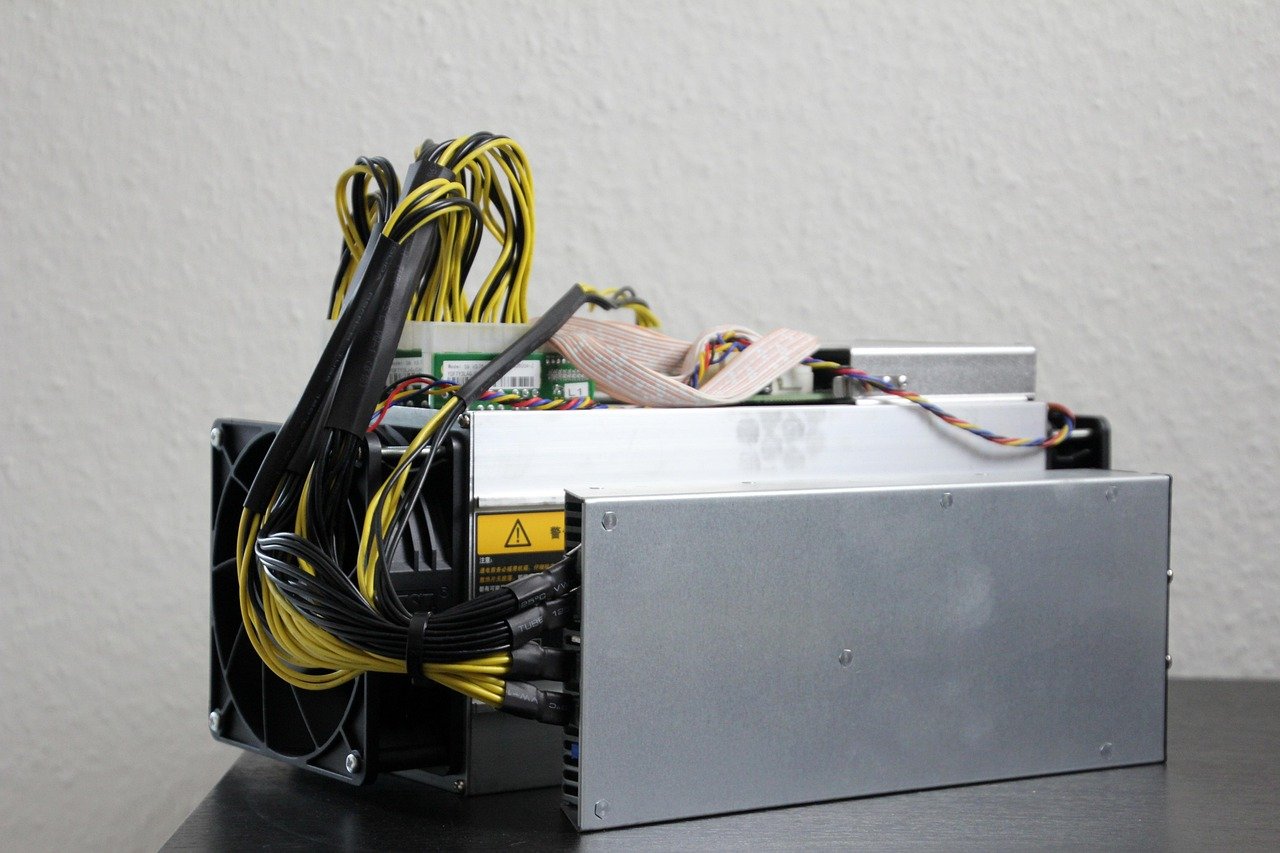

To better understand staking, it’s important to compare it to the traditional Proof-of-Work (PoW) consensus mechanism, used by Bitcoin.

- Proof-of-Work (PoW): Requires miners to solve complex cryptographic puzzles to validate transactions. This process is energy-intensive.

- Proof-of-Stake (PoS): Validators are selected based on the amount of crypto they stake. It’s more energy-efficient and allows for faster transaction processing.

PoS is designed to be more scalable and environmentally friendly than PoW, making staking an attractive option for many crypto investors.

How Does Staking Work?

Choosing a Cryptocurrency to Stake

Not all cryptocurrencies support staking. The first step is to identify a crypto that uses a PoS consensus mechanism or a variant thereof. Popular staking options include Ethereum (ETH), Cardano (ADA), Solana (SOL), Polkadot (DOT), and Tezos (XTZ).

Consider these factors when choosing a cryptocurrency to stake:

- Project’s Legitimacy: Research the project’s team, technology, and roadmap. Avoid projects with vague or unrealistic goals.

- Staking Rewards: Compare the Annual Percentage Yield (APY) offered by different cryptocurrencies. Higher APY doesn’t always mean a better investment; consider the risk.

- Lock-up Period: Some staking platforms require you to lock up your crypto for a specific period (e.g., 30 days, 90 days, or longer). Consider your liquidity needs.

- Inflation Rate: Understand the token’s inflation rate. If the inflation rate is higher than your staking rewards, your holdings may be devalued over time.

Staking Methods: Centralized vs. Decentralized

You can stake your crypto through various methods:

- Centralized Exchanges (CEXs): Platforms like Binance, Coinbase, and Kraken offer staking services. They handle the technical aspects of staking for you. This is the easiest option for beginners.

- Decentralized Exchanges (DEXs): Platforms like Uniswap and PancakeSwap may offer staking opportunities through liquidity pools. Requires more technical knowledge.

- Native Wallets: Some cryptocurrencies have their own official wallets that allow you to stake directly. This gives you more control over your crypto.

- Staking Pools: Joining a staking pool allows you to combine your crypto with other participants, increasing your chances of earning rewards. These pools often charge a fee.

Choosing the right method depends on your technical expertise and risk tolerance. Centralized exchanges are generally more user-friendly, while decentralized options offer more control and potentially higher rewards (but also higher risk).

Setting Up Your Staking Wallet

Before you can start staking, you’ll need a compatible wallet. Here are a few common types:

- Software Wallets (Hot Wallets): These are applications you install on your computer or smartphone (e.g., MetaMask, Trust Wallet). They are convenient but less secure than hardware wallets.

- Hardware Wallets (Cold Wallets): These are physical devices that store your private keys offline (e.g., Ledger, Trezor). They offer the highest level of security.

- Exchange Wallets: While you are staking on an exchange, your funds are technically within their wallet infrastructure.

Secure your wallet by:

- Enabling two-factor authentication (2FA).

- Storing your seed phrase in a safe and offline location.

- Regularly updating your wallet software.

Benefits and Risks of Staking

Advantages of Crypto Staking

- Passive Income: Earn rewards simply by holding and staking your crypto.

- Contribution to Network Security: Help secure the blockchain network and validate transactions.

- Lower Barrier to Entry: Staking requires less technical expertise compared to mining.

- Energy Efficiency: Contributes to a more sustainable cryptocurrency ecosystem.

- Potential for Capital Appreciation: You can potentially earn staking rewards while also benefiting from price appreciation of the staked cryptocurrency.

Potential Risks to Consider

- Price Volatility: The value of your staked crypto can fluctuate significantly.

- Lock-up Periods: Your crypto may be inaccessible for a specific period.

- Slashing: Validators can lose a portion of their staked crypto if they act maliciously or fail to properly validate transactions.

- Validator Risks: If you are delegating your stake to a validator, that validator’s poor performance or malicious activity can negatively affect your returns. Research your validators!

- Protocol Risk: Smart contract vulnerabilities or failures in the blockchain protocol can lead to loss of funds.

- Regulatory Risks: The regulatory landscape for cryptocurrencies and staking is constantly evolving. Changes in regulations could impact staking rewards or even prohibit staking altogether.

Optimizing Your Staking Strategy

Choosing the Right Staking Pool

When staking through a pool, consider these factors:

- Pool Size: Larger pools may offer more stable rewards but lower individual returns.

- Pool Fees: Pools typically charge a fee on rewards. Compare fees across different pools.

- Pool Reputation: Research the pool’s track record and reputation within the community.

- Validator Uptime: Aim for validators with high uptime records, indicating reliable performance.

Understanding APY and ROI

- Annual Percentage Yield (APY): Represents the total amount of rewards you can earn in a year, taking into account compounding.

- Return on Investment (ROI): Measures the profitability of your staking investment over a specific period.

Always compare APY and ROI across different staking options to make informed decisions. Be aware that advertised APYs can change.

Compound Interest and Restaking

Consider restaking your rewards to take advantage of compound interest. This can significantly increase your earnings over time. Many staking platforms offer automatic restaking options.

Example: If you earn 10% APY on your initial stake and restake your rewards each year, your earnings will compound, resulting in higher overall returns compared to simply withdrawing your rewards.

Conclusion

Staking provides a compelling opportunity to earn passive income while contributing to the security and efficiency of blockchain networks. However, it’s crucial to understand the benefits and risks involved before diving in. By carefully researching different cryptocurrencies, staking methods, and optimizing your strategy, you can maximize your potential returns while mitigating potential risks. Remember to prioritize security, diversify your holdings, and stay informed about the evolving landscape of the crypto staking ecosystem.