Navigating the world of finance and digital assets often leads to the concept of “exchanges.” But what exactly is an exchange, and how do they function in today’s complex market landscape? This comprehensive guide delves into the various types of exchanges, their functionalities, and how to effectively utilize them for different investment goals.

What is an Exchange?

An exchange, in its broadest sense, is a marketplace where different assets can be traded. This can encompass a wide range of assets, from traditional stocks and bonds to modern cryptocurrencies and commodities. The primary function of an exchange is to facilitate the buying and selling of these assets, providing a centralized platform where buyers and sellers can interact and agree on prices.

Traditional Stock Exchanges

- Functionality: These exchanges, like the New York Stock Exchange (NYSE) or the NASDAQ, primarily deal with stocks and bonds of publicly traded companies. They provide a regulated environment for companies to raise capital and for investors to trade ownership in those companies.

- Regulation: Traditional stock exchanges are heavily regulated by government agencies like the Securities and Exchange Commission (SEC) in the United States, ensuring fair practices, transparency, and investor protection.

- Example: Investing in Apple (AAPL) requires purchasing shares through a broker who executes the trade on an exchange like NASDAQ.

Foreign Exchange (Forex) Market

- Functionality: The Forex market is a decentralized global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with trillions of dollars changing hands daily.

- Decentralized Nature: Unlike stock exchanges, Forex operates without a central location. Trades occur electronically between a network of banks, institutions, and individual traders.

- Example: A business needing to convert USD to EUR for international transactions participates in the Forex market.

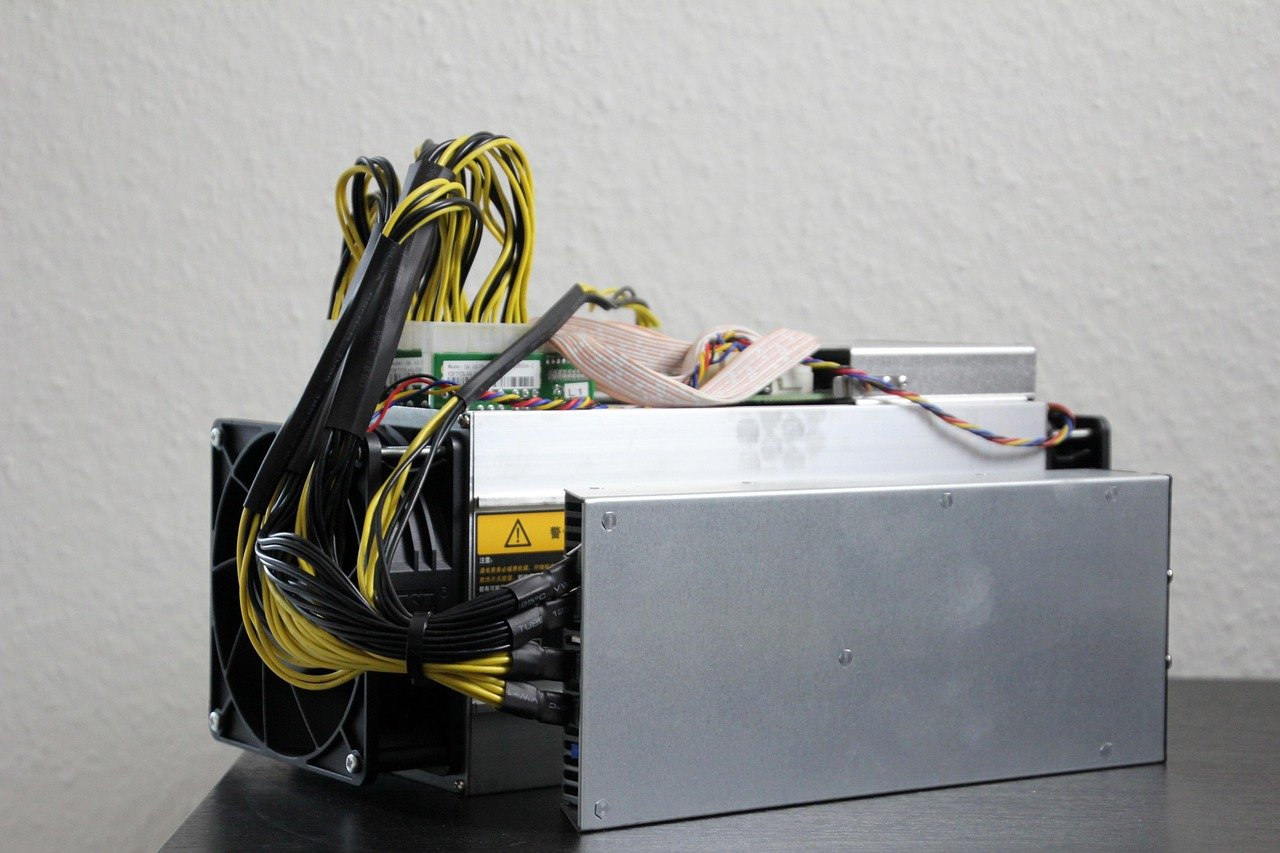

Cryptocurrency Exchanges

Cryptocurrency exchanges are platforms specifically designed for trading cryptocurrencies like Bitcoin, Ethereum, and hundreds of other altcoins. These exchanges provide the infrastructure for users to buy, sell, and trade digital assets.

Centralized Exchanges (CEXs)

- Functionality: CEXs, such as Coinbase, Binance, and Kraken, act as intermediaries between buyers and sellers. They offer user-friendly interfaces, a wide range of trading pairs, and various features like margin trading.

- Security and Regulation: CEXs often implement robust security measures to protect user funds. However, they are also subject to regulatory scrutiny, varying by jurisdiction.

- Example: Using Binance to buy Bitcoin with USD or trading Bitcoin for Ethereum.

Decentralized Exchanges (DEXs)

- Functionality: DEXs, like Uniswap and PancakeSwap, operate on blockchain technology, eliminating the need for a central authority. They use smart contracts to automate trading and provide users with greater control over their funds.

- Key Features: DEXs typically offer features like liquidity pools and yield farming. They are generally permissionless, meaning anyone can participate without KYC (Know Your Customer) verification.

- Example: Providing liquidity to a Uniswap pool for the ETH/DAI trading pair and earning fees from trades.

- Benefits:

Increased privacy and control.

Reduced risk of censorship.

* Potential for higher returns through yield farming.

Choosing the Right Cryptocurrency Exchange

- Security: Look for exchanges with strong security measures, such as two-factor authentication (2FA), cold storage for funds, and regular security audits.

- Fees: Compare trading fees, withdrawal fees, and deposit fees across different exchanges.

- Liquidity: Choose exchanges with high trading volume to ensure your orders are filled quickly and efficiently.

- User Interface: Select an exchange with a user-friendly interface that meets your trading experience level.

- Supported Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you want to trade.

- Regulation: Check if the exchange is compliant with relevant regulations in your jurisdiction.

Types of Orders on Exchanges

Understanding the different types of orders is crucial for effective trading on any exchange. Here are some common order types:

- Market Order: An order to buy or sell an asset immediately at the best available price. Market orders guarantee execution but not necessarily at the desired price.

- Limit Order: An order to buy or sell an asset at a specific price or better. Limit orders provide price control but do not guarantee execution.

- Stop Order: An order to buy or sell an asset when the price reaches a certain level (the stop price). Stop orders are often used to limit losses or protect profits.

- Stop-Limit Order: A combination of a stop order and a limit order. Once the stop price is reached, a limit order is placed.

Exchange Fees and Considerations

Exchanges generate revenue through various fees, and understanding these fees is essential for managing trading costs.

- Trading Fees: Fees charged for each trade executed on the exchange. These fees typically range from 0.1% to 0.5% per trade.

- Withdrawal Fees: Fees charged when withdrawing funds from the exchange. These fees vary depending on the asset and the exchange.

- Deposit Fees: Some exchanges may charge fees for depositing funds. However, many exchanges offer free deposits.

- Spread: The difference between the bid price (the highest price a buyer is willing to pay) and the ask price (the lowest price a seller is willing to accept). The spread represents a hidden cost of trading.

- Slippage: The difference between the expected price of a trade and the actual price at which the trade is executed. Slippage is more common in volatile markets or on exchanges with low liquidity.

It’s crucial to factor in all potential fees when calculating the profitability of your trades. High fees can significantly impact your returns.

Conclusion

Exchanges are fundamental components of the modern financial landscape, facilitating the buying and selling of a diverse array of assets. From traditional stock exchanges to cutting-edge cryptocurrency platforms, understanding the functionalities, regulations, and nuances of each type of exchange is paramount for investors and traders alike. By carefully considering factors like security, fees, liquidity, and regulation, users can navigate the world of exchanges effectively and make informed decisions to achieve their investment goals.