Capital gains, the profits earned from selling assets like stocks, bonds, real estate, and even collectibles, are a fundamental aspect of investing and financial planning. Understanding how capital gains are taxed can significantly impact your investment returns and overall financial strategy. This guide provides a comprehensive overview of capital gains, covering everything from the basics to tax implications and strategies for minimizing your tax burden.

Understanding Capital Gains

Capital gains represent the profit you make when you sell an asset for more than you paid for it. The type of asset, how long you held it, and your income level all influence how these gains are taxed. Ignoring capital gains and their tax implications can lead to unwelcome surprises during tax season, so being informed is crucial.

What are Capital Assets?

Capital assets are any property you own that could potentially increase in value. These assets can include:

- Stocks

- Bonds

- Real Estate (primary residence, rental properties, land)

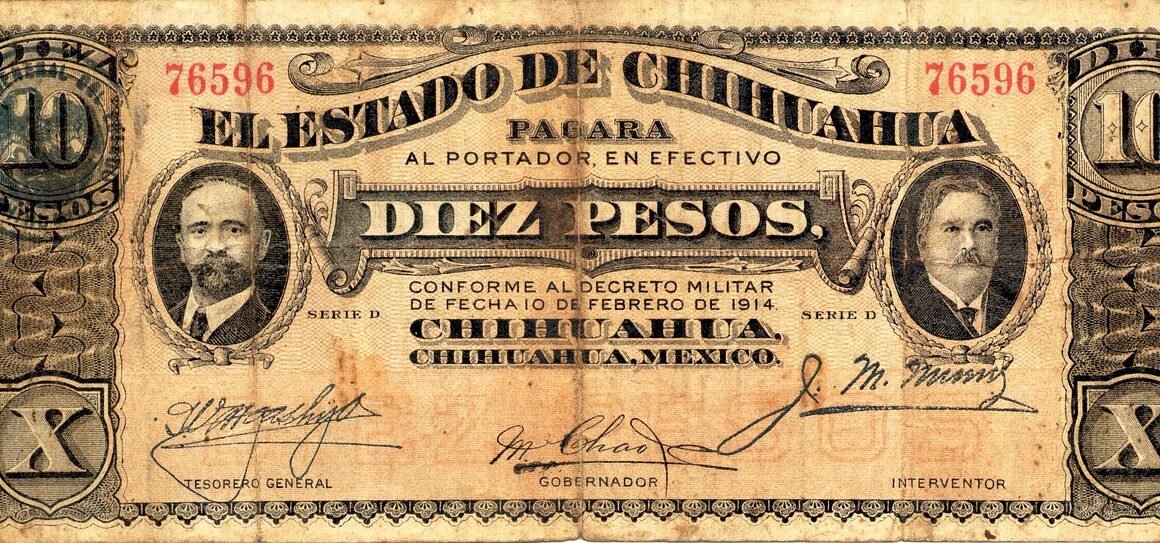

- Collectibles (artwork, antiques, stamps, coins)

- Cryptocurrencies

Essentially, if you buy something with the expectation that it might appreciate in value and you plan to sell it later for a profit, it’s likely a capital asset.

Short-Term vs. Long-Term Capital Gains

A crucial distinction is whether a capital gain is considered short-term or long-term. This depends on how long you held the asset before selling it.

- Short-term capital gains: Result from assets held for one year or less. These gains are taxed at your ordinary income tax rate, which can be significantly higher than long-term rates.

- Long-term capital gains: Result from assets held for more than one year. These gains are taxed at preferential rates, typically lower than ordinary income tax rates. These rates depend on your taxable income.

- Example: You bought shares of a company for $1,000 and sold them six months later for $1,500. The $500 profit is a short-term capital gain and will be taxed at your ordinary income tax rate. If you held those same shares for 18 months before selling, the $500 profit would be a long-term capital gain, potentially taxed at a lower rate.

Capital Gains Tax Rates

Understanding the applicable tax rates is essential for effective financial planning. Capital gains tax rates vary depending on your income and the holding period of the asset.

Long-Term Capital Gains Tax Rates

As of 2023, long-term capital gains tax rates are generally 0%, 15%, or 20%, depending on your taxable income.

- 0%: For taxpayers in the lower income tax brackets.

- 15%: For most taxpayers.

- 20%: For taxpayers with higher incomes.

There’s also a 3.8% Net Investment Income Tax (NIIT) that may apply to higher-income taxpayers. This tax is applied to the lesser of your net investment income or the amount by which your modified adjusted gross income (MAGI) exceeds certain threshold amounts.

- Example: If you are single and your taxable income is $50,000, your long-term capital gains may be taxed at 15%. However, if your income is $500,000, your long-term capital gains may be taxed at 20%, plus potentially the 3.8% NIIT.

Short-Term Capital Gains Tax Rates

Short-term capital gains are taxed as ordinary income. This means they are taxed at the same rate as your wages, salary, or other income. These rates can range from 10% to 37%, depending on your income tax bracket.

- Example: If you’re in the 22% tax bracket, any short-term capital gains you realize will be taxed at 22%.

Capital Gains and Qualified Dividends

Qualified dividends, which are dividends that meet certain requirements, are also taxed at the same long-term capital gains rates as assets held for over a year. This similarity in tax treatment can often simplify investment planning.

Calculating Capital Gains and Losses

Accurately calculating your capital gains and losses is fundamental for correctly reporting them on your tax return.

Determining Your Basis

Your basis is generally the original purchase price of the asset, plus any costs associated with the purchase (e.g., brokerage fees). This number is crucial for determining the profit or loss on the sale. If you inherit an asset, your basis is usually the fair market value of the asset at the time of the deceased’s death.

- Purchase Price: The amount you originally paid for the asset.

- Additional Costs: Expenses like brokerage commissions, transfer fees, and legal fees.

- Improvements: For real estate, this includes capital improvements that increase the value of the property.

Calculating the Gain or Loss

The calculation is straightforward: Subtract your basis from the selling price.

- Capital Gain: Selling Price – Basis > 0

- Capital Loss: Selling Price – Basis < 0

- Example: You bought a stock for $5,000 (including commissions) and sold it for $8,000. Your capital gain is $3,000 ($8,000 – $5,000).

Capital Loss Limitations

While capital gains are taxable, capital losses can be used to offset capital gains. If your capital losses exceed your capital gains, you can deduct up to $3,000 of the excess loss against your ordinary income each year ($1,500 if married filing separately). Any remaining losses can be carried forward to future tax years.

- Example: You have $10,000 in capital gains and $15,000 in capital losses. You can offset the $10,000 in gains with $10,000 of losses, and then deduct $3,000 from your ordinary income. The remaining $2,000 in losses can be carried forward to future years.

Strategies for Managing Capital Gains Taxes

There are several strategies you can use to minimize your capital gains tax liability. Proactive planning is key to maximizing your investment returns.

Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have lost value to offset capital gains. This can reduce your current tax liability and potentially increase your future investment returns by reinvesting the tax savings.

- Identify Losing Investments: Regularly review your portfolio to identify assets that have declined in value.

- Sell the Assets: Sell the losing assets to realize the capital loss.

- Offset Gains: Use the capital loss to offset capital gains.

- Repurchase Similar Assets (Carefully): Be mindful of the “wash-sale rule,” which prevents you from repurchasing substantially identical assets within 30 days before or after the sale. Otherwise, the loss is disallowed.

- Example: You have a $5,000 capital gain. You also have a stock that has lost $5,000 in value. You sell the losing stock to realize a $5,000 capital loss, which offsets your $5,000 capital gain, resulting in zero capital gains tax liability.

Asset Location

Strategic asset location involves placing different types of investments in different types of accounts to minimize taxes.

- Tax-Advantaged Accounts: Use tax-advantaged accounts like 401(k)s and IRAs for investments that generate ordinary income (like bonds) and high-turnover investments that generate short-term capital gains.

- Taxable Accounts: Place investments with lower turnover and potential for long-term capital gains (like stocks) in taxable accounts.

Long-Term Investing

Holding assets for longer than one year allows you to take advantage of lower long-term capital gains tax rates. This strategy encourages a buy-and-hold approach, which can also reduce transaction costs and improve long-term returns.

- Example:* Instead of frequently buying and selling stocks, focus on investing in companies with long-term growth potential and holding those stocks for several years to qualify for long-term capital gains rates.

Charitable Donations

Donating appreciated assets, such as stock, to a qualified charity can provide a double tax benefit. You can deduct the fair market value of the asset from your income, and you avoid paying capital gains taxes on the appreciation.

Conclusion

Understanding capital gains and the associated tax implications is critical for effective investing and financial planning. By familiarizing yourself with the different types of capital gains, tax rates, and strategies for managing capital gains taxes, you can make informed decisions that optimize your investment returns and minimize your tax liability. Remember to consult with a qualified tax professional for personalized advice based on your specific financial situation.